Marvelous Info About How To Improve A Low Credit Score

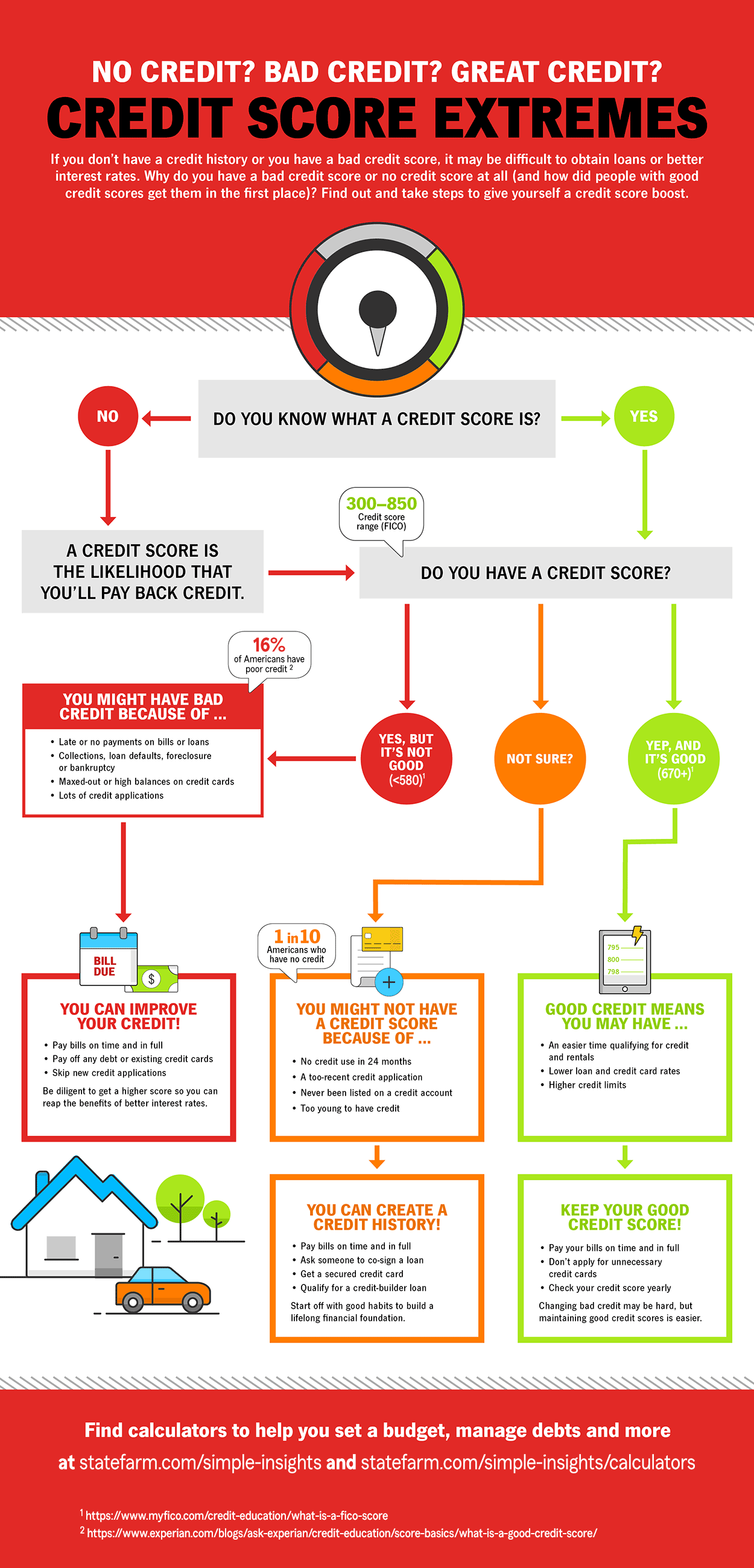

Maintaining a good credit score can get you access to loans and new lines of credit at favorable rates.

How to improve a low credit score. Get expert help improving your credit. Check your credit report for errors. Ad increase your fico® score & get credit for the bills you're already paying.

This type of loan, backed by the federal housing administration (fha), can help buyers with lower credit scores get into a home. Stay focused to improve your credit. Therefore, the next important step to take to improve your credit score would be to keep your credit utilization as low as possible.

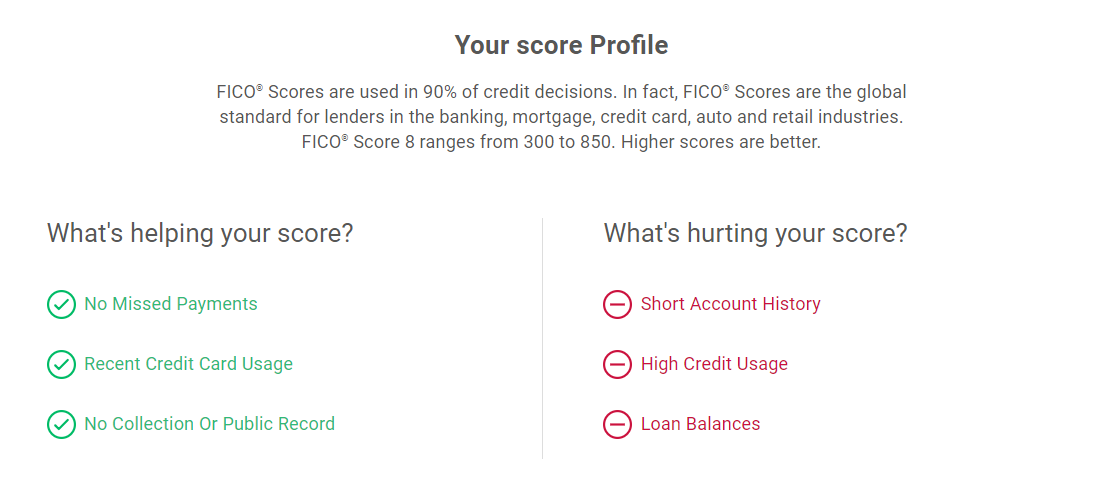

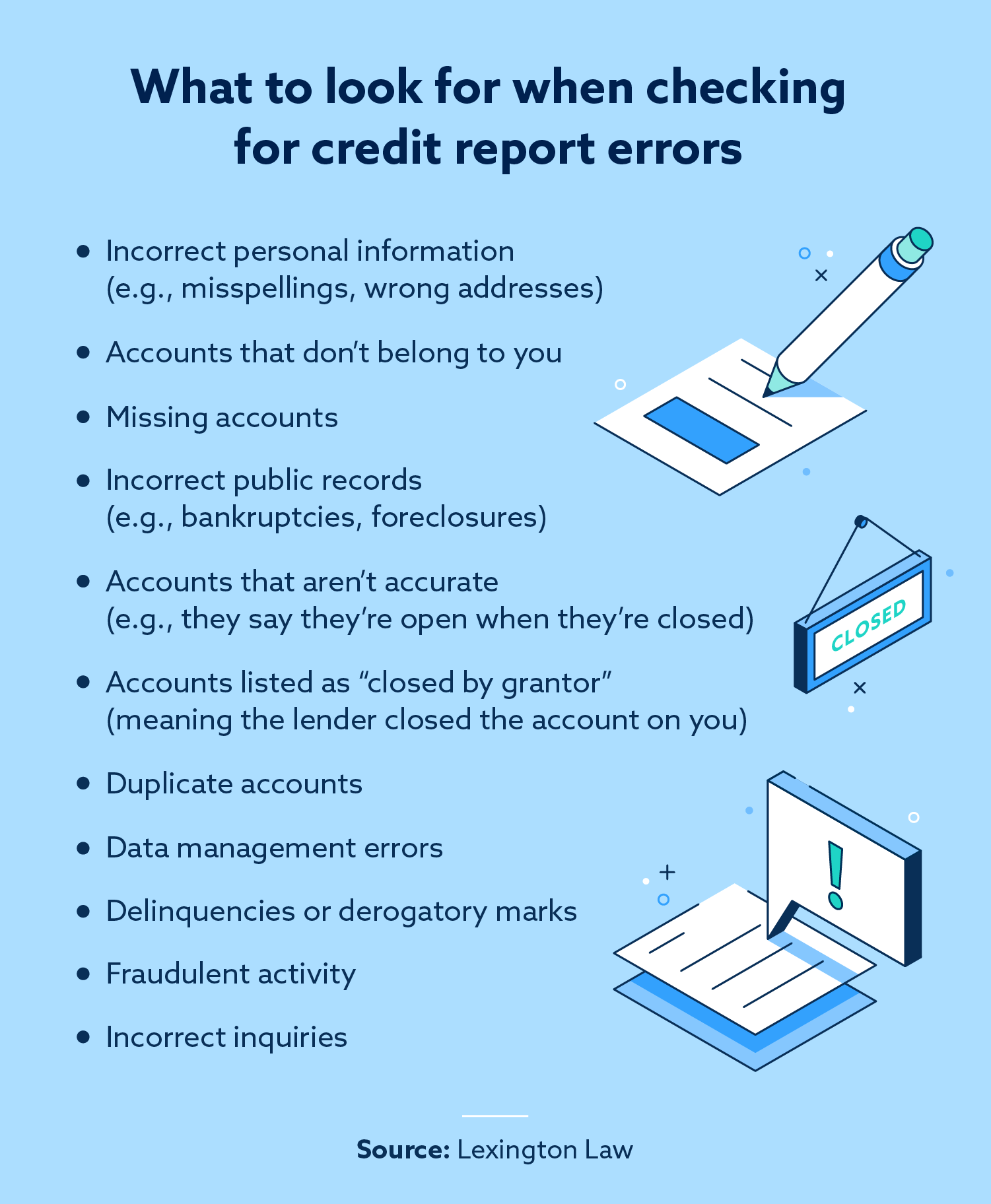

You can increase your fico® score for free. One way to quickly increase your credit score is to review your credit report for any errors that could be negatively impacting you. The total amount of money one owes will show how deep into debt they are and will affect their credit score.

It takes time to improve your credit, and can be challenging on a low income. A credit score of 661 or higher has an interest rate at about 5.53%. Try not to open any new credit card accounts that aren’t necessary.

You have a good credit score. Ad learn what's wrong with your credit with a free personalized consultation today! Generally, when you open a new credit account, it will lower your credit score slightly, at least for a short period.

A history of prompt payment will improve a low credit score. A low credit score indicates that you may have failed to pay credit card bills on time or have delayed paying emis. Missed payments, defaults and court judgments will stay on your credit report for six years.

:max_bytes(150000):strip_icc()/common-things-that-improve-and-lower-credit-scores2-f5cf389fdf4f46579ddcc49d8db40525.png)