Real Info About How To Check If A Bank Is Fdic Insured

Such payments usually begin within a few days after the bank closing.

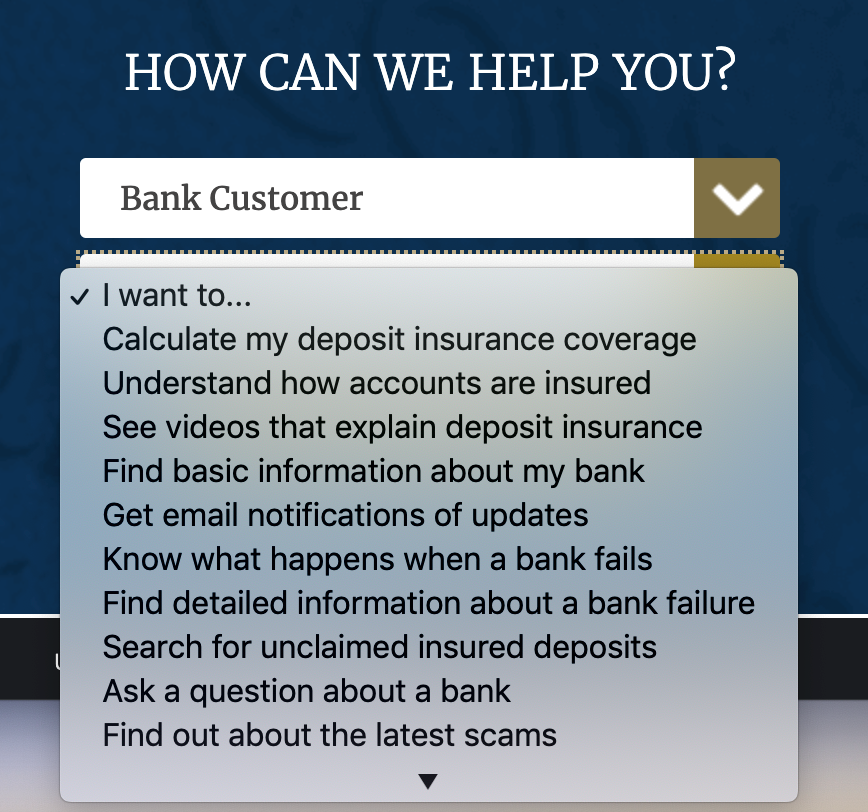

How to check if a bank is fdic insured. Go to bankfind institution directory (id) In this case, the fdic will pay you directly by check up to the insured balance in each account. Submitting this information to the fdic is.

§§ 1819, 1821, and 1822) and 12 c.f.r. Call us to determine your deposit insurance coverage or ask any other specific deposit insurance questions. Do that easily, by selecting the state where the bank is located, from the drop down menu above.

In addition, the following organizations have compiled lists of banks that offer. Simple searches, like a partial name instead of a whole, will produce more results. The fdic will use the information to help individuals with accounts at a failed institution determine the insurance status of their accounts.

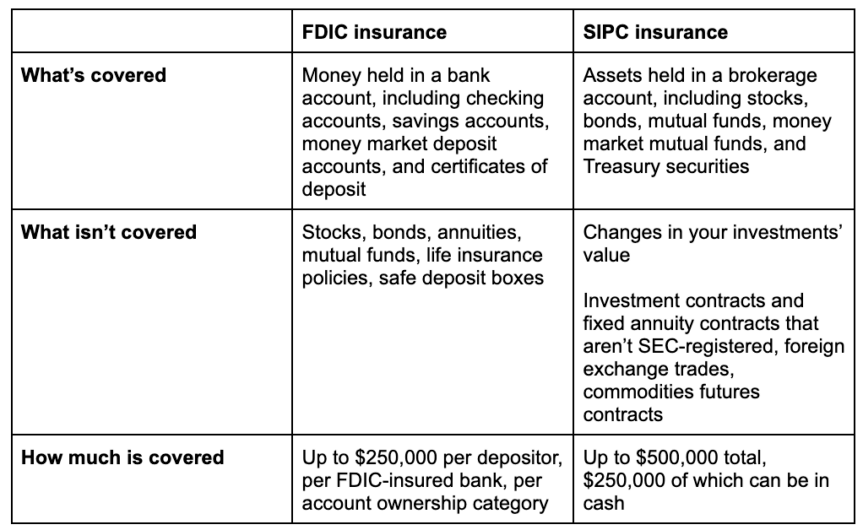

A quick way to find out if your deposits are insured is to search for your bank on the fdic’s bankfind tool. Loginask is here to help you access fdic insured bank account quickly and handle. A single account is owned by one person, and all of that person's single accounts at a bank will be added together and insured up to $250,000.

To ensure funds are fully protected, depositors should understand their. Loginask is here to help you access fdic insured bank accounts amount. 1 ] determine if the institution you bank at, is a member of the fdic insurance program.

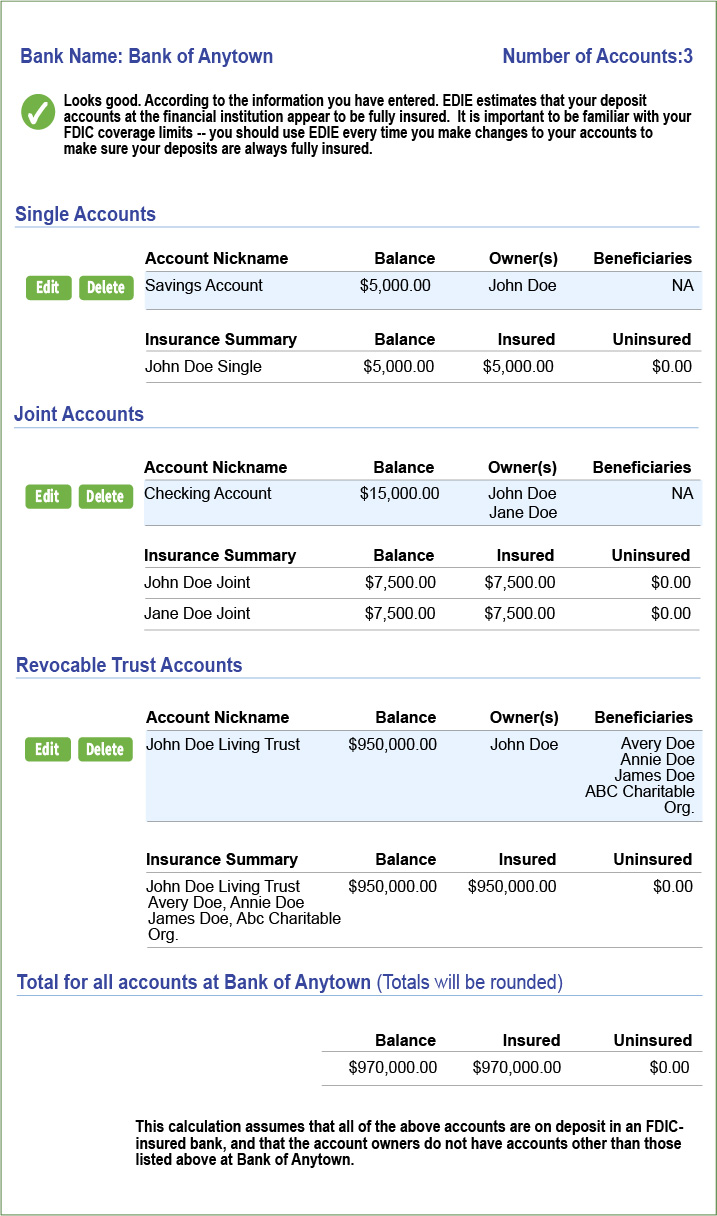

For more information about fdic coverage, visit the fdic website at www.fdic.gov or access the electronic deposit insurance estimator (edie the estimator), an online tool that provides. You can confirm that your bank is fdic insured by using the fdic’s bankfind suite. Fdic insured bank accounts amount will sometimes glitch and take you a long time to try different solutions.

/FDIC_Seal_by_Matthew_Bisanz-b92facd3f0304834b33c305f7f9b2007.jpeg)

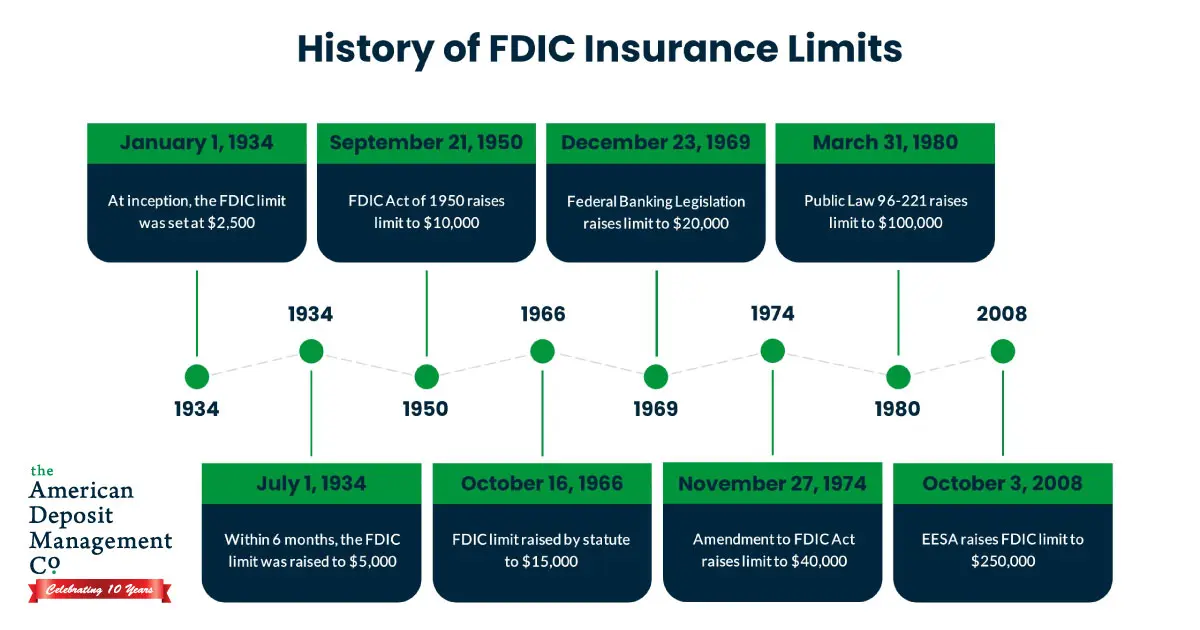

:max_bytes(150000):strip_icc()/fdic-history_V1-5912fcf474b04c5891e185fd3145f6d0.jpg)

/fdic-history_V1-5912fcf474b04c5891e185fd3145f6d0.jpg)