Lessons I Learned From Info About How To Increase Tsp Contribution

Employees can contribute up to $19,500 to their tsp plan for 2020, $500 more than 2019.

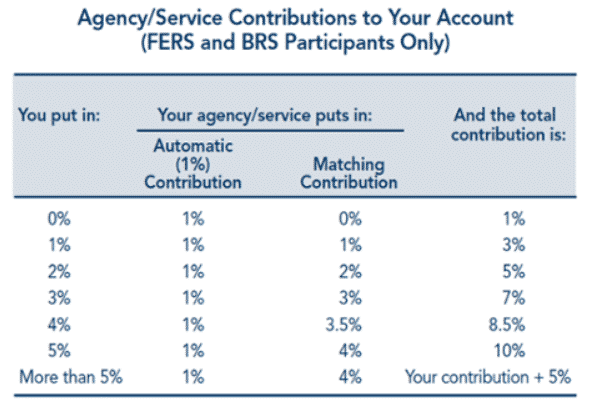

How to increase tsp contribution. If you do it per pp i believe it is $789/pp to max it. Additionally, the limits apply to. If you’re a fers or csrs employee or a brs member who began or rejoined federal service after october 1, 2020, your agency or service automatically.

These inflation adjusted raises are. Eligible to receive either type of agency contribution. How do i increase (or decrease) my contribution to the tsp?

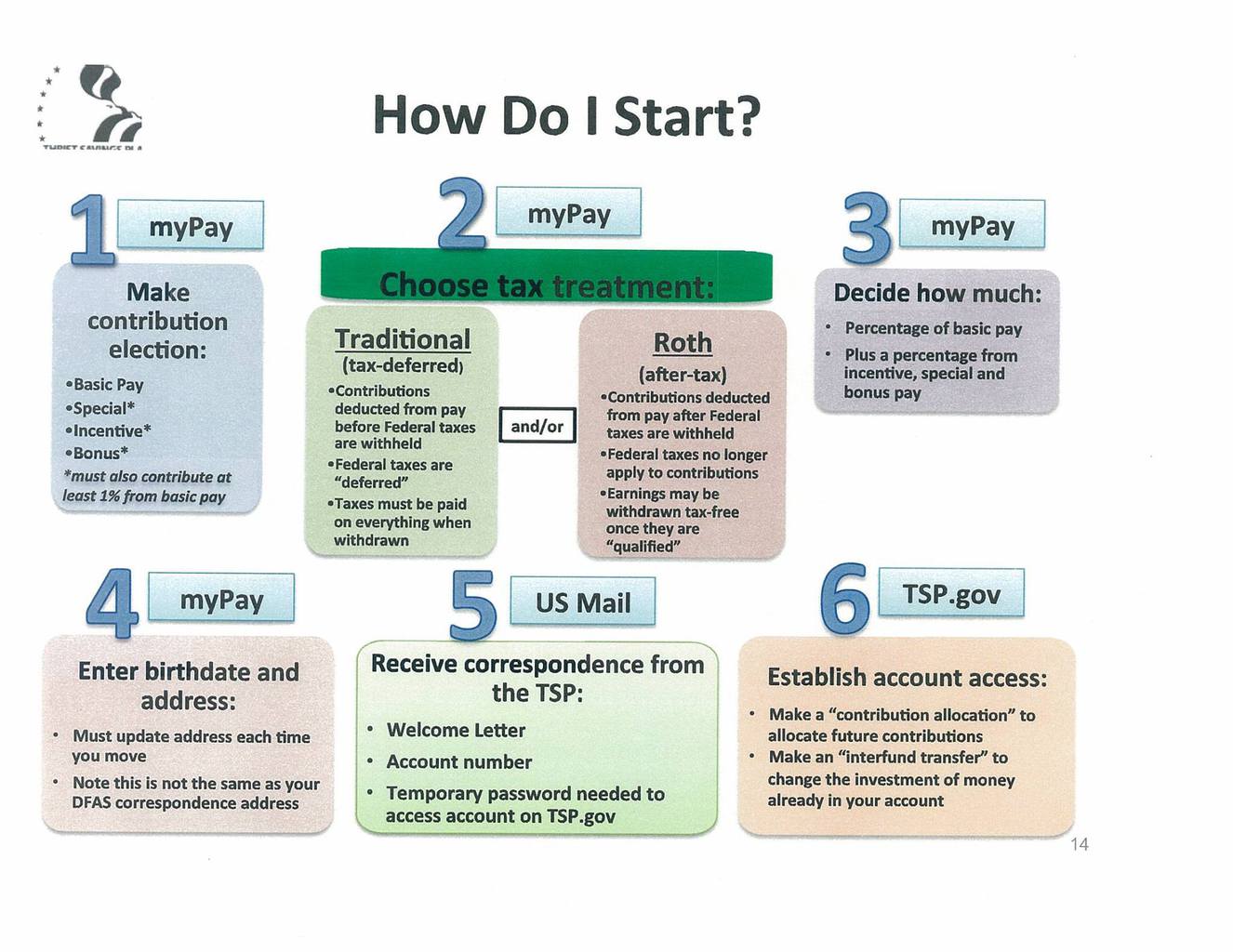

How do i make a tsp contribution election? Go to your epp page and do it through there. Starting in 2022, the contribution limit for tsp participants will increase to $20,500, up from $19,500 in 2021.

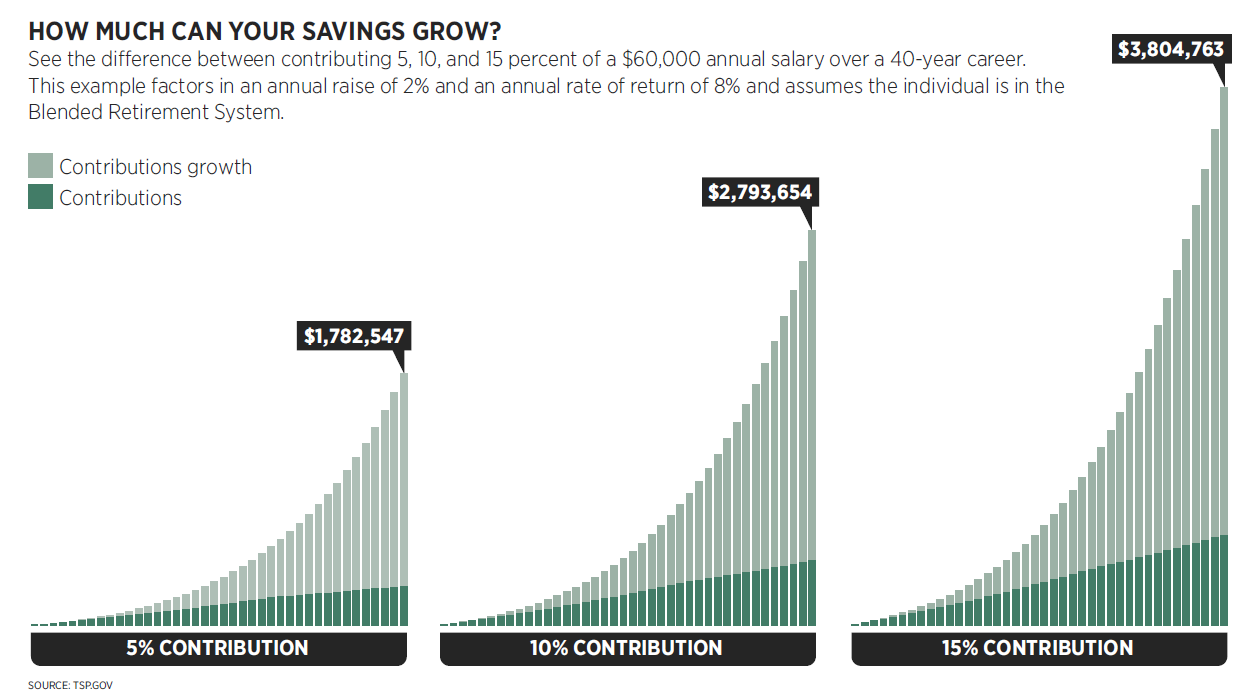

You can enroll, change, or stop your thrift savings plan (tsp) contribution amount at any time, but you may make only one. All eligible employees are automatically enrolled in tsp at a five percent contribution rate. Once you have logged into your tsp account, select “contribution allocations” on the left side under “online transactions.” from the “contribution allocations” page, click on the “request.

The irs has announced a $500 increase in the elective deferral limit for 2018, allowing tsp participants to contribute up to $18,500. You can change the amount of your pay that you are contributing to the tsp only during an open season. These contribution limits apply to all employees who participate in the federal government’s thrift savings plan, 401(k), 403(b), and 457 plans.